1.The Factories Act -1948 : Lot of changes to be comes under such as in Welfare Measures i.e.Canteen, Creche etc., Appointment of Safety Officers etc., Do not take any action against the employer by Police to FIR, If any accident takes place leads to death etc.

2. The ESI Act - 1948 : 1.Wage ceiling for coverage of employees is up to Rs.15,000/-per month.Conveyance Allowance is excluded under the part of wage.3. Maintenance of Previous Records for Inspection up to 5 years only.

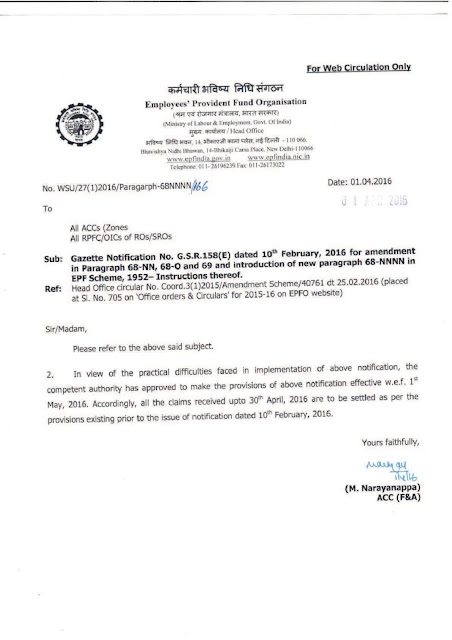

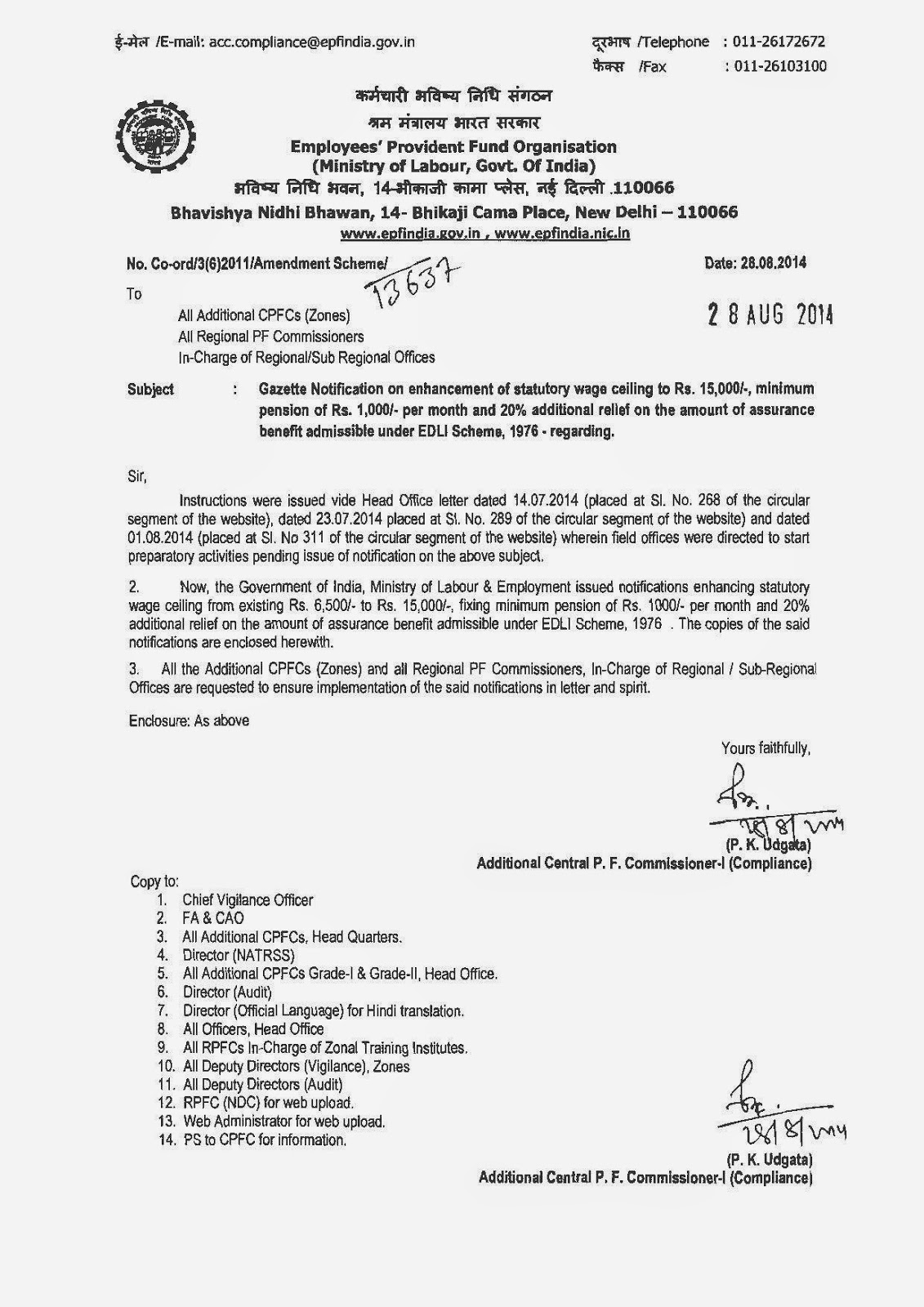

3. The EPF Act - 1952 :1.Under EDLI - The Benifit has been extended from Rs.1,00,000/- to Rs.1,30,000/-

4. The Workmen Compensation Act - 1923 : Compensation under1. Death i.e.Minimum is 1,20,000, Maximum is

Rs.4,25,000/- 2. Permanent Disablement - Minimum - Rs.1,40,000, Maximum is 5,40,000/- 2. Computation for calculation of compensation on wages has been extended from Rs.4,000/- to Rs.8,000/-.3. The Act can be amended as Employees Compensation Act. 4. Casual Labour are also covered under the act as per latest amendment.

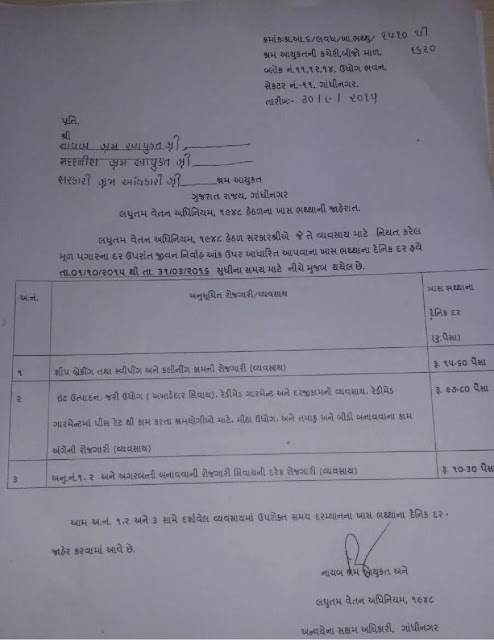

5. The Payment of Wages Act - 1936 : Wages to be paid either through deposit in Bank or by cheque.

6. The Payment of Bonus Act - 1965 : Amendment has been proposed to extend wage ceiling from Rs.10,000/- to Rs.15,000/- and also for computation of Bonus from Rs.3,500/- to Rs.5,000/-.Minimum Bonus has also extended from 8.33% to 11%.

7. The Payment of Gratuity Act - 1972 : Maximum Payment under Gratuity has been extended from RS.3,50,000 to Rs.10,00,000/- 2. Compulsory Insurance coverage for employees under Gratuity Act.

8. The Industrial Dispute Act - 1947 : U/s 11a and impact of Sec2 a, any workmen will directly approaches to Labour Court and Tribunal Directly with out concilliation , if they are discharged, dismissed, terminated from service.

9. The Contract Labour Act - 1970 : Non Compliance under statutory provisions , contract labour to be deemed as employees of the priniciple employer.